Venmo is owned by PayPal, but the company was founded by American entrepreneurs and college buddies; Andrew Kortina and Iqram Magdon-Ismail in 2009.

Venmo is an American-based mobile payment service. The Venmo mobile application works on iPhone, Android, and Blackberry devices, allowing users to send and receive money. The original idea behind Venmo was to enable friends and acquaintances to share bills such as rents, movie tickets, restaurants, and shopping bills, etc. This service, however, is available only to people resident in the USA and is popular among young people. It has about 65 million users.

In case you have ever wondered where the name “Venmo” originated from, Andrew, a co-founder of the platform, has an answer for you. According to him, they were inquiring into the Latin root Vendere ‘sell’ and ‘mo’ for mobile, but entirely as a means to get to a name that was short, has an easily understood spelling, could be a verb (e.g Just Venmo me), and was also cheap. Thankfully, the name “Venmo” was up for grabs on GoDaddy and met the criteria that were important to them, so they grabbed it.

Venmo Is Currently Owned By PayPal

Venmo is currently a subsidiary of PayPal. It was acquired by Braintree for $26.2 million in 2012 and in turn, PayPal acquired Braintree for $800 million in December 2013. With the acquisition of Braintree, PayPal automatically gained ownership of Venmo in 2013. PayPal Holdings Inc. is a multinational financial technology company based in America and operates an online payments system in countries that allow such services. PayPal was worth an estimated $21.45 billion in revenue as of 2020.

Venmo has witnessed significant improvement since its acquisition by PayPal. It is now able to carry out customer-to-business transactions on its platform and businesses that

accept PayPal can as well accept Venmo. In 2020, PayPal announced that the company was launching an initiative that will allow PayPal and Venmo users to buy and use cryptocurrencies such as Bitcoin, Bitcoin Cash, Ethereum, and Litecoin in selected international markets by the first half of 2021.

Venmo launched a debit card available for her account holders in 2018. Venmo debit card runs on the MasterCard network and allows for ATM access and overdraft protection. The card can be used anywhere that MasterCard is accepted and enables up to $400 ATM withdrawals daily. While PayPal is a public company listed on the stock exchange, Venmo as a subsidiary does not trade on the stock market.

With Venmo and PayPal under the same umbrella, clients that favor online payment services have very secure and convenient options to choose from. And while millennials and Gen Zs find Venmo trendy, Xenials may find PayPal convenient as it does not have the social media-like features of Venmo.

The Digital Payment Platform Was Founded In 2009

Venmo was founded on April 4, 2009, by New York-based American entrepreneur Andrew Kortina and Zimbabwe-born American entrepreneur Iqram Magdon-Ismail. The founders met in their first year of college as roommates at the University of Pennsylvania.

Before Venmo became a thing, Kortina and Magdon-Ismail started a company together called My College Post but it was not successful. However, their friendship continued after graduation as they became roommates in Philadelphia and continued to work together.

The Story Behind The Creation Of Venmo

After Andrew and Iqram graduated from the university, they spent a few years working at different companies and in the process, they gathered a lot of knowledge and experience that would help them in the future. Then, around the beginning of 2009, the two friends, armed with the knowledge they have gained from their jobs, decided that they would start spending their weekends brainstorming on different ideas together.

Their first idea was conceived while helping a friend establish a yogurt shop. In the process of getting the business running technically, they “realized how horrible traditional point of sales software was”, according to Kortina in a blog post, and that inspired them to create a transaction solution. Thus, they created a software that when installed, would transform any laptop into a cash register. This was good and inexpensive but because distribution would pose a problem, and they also did not envision themselves making use of the product every day, they were not excited to take it far.

The Idea Of Venmo Was Thought Up At A Local Jazz Show

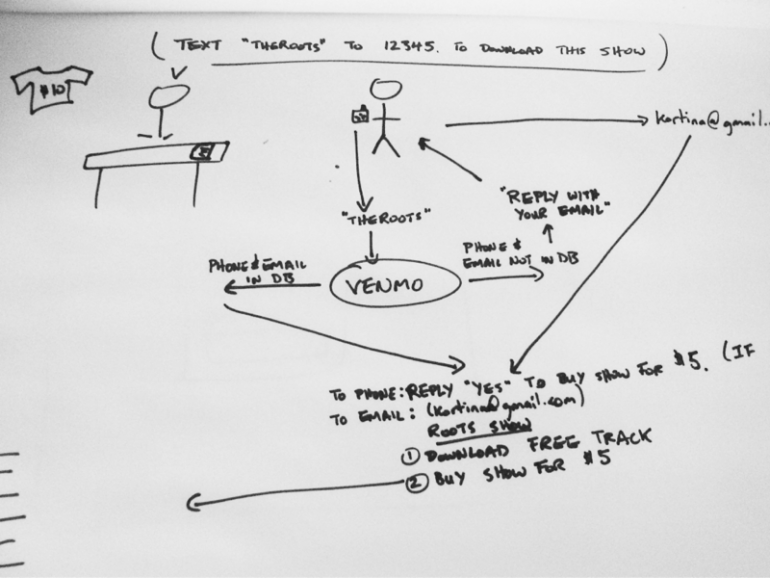

The duo conceived their next idea at a local jazz show. They thought it would be nice if one could just get an MP3 of the show delivered to one’s email by simply sending an SMS to the band.

However, they did not pay much attention to this idea of possibly sending money through SMS until Magdon-Ismail forgot his wallet in Philadelphia while on a trip to see his friend Andrew Kortina in New York one weekend. Consequently, Andrew had to cover him. The inconvenience that arose from forgetting his wallet made the Venmo founders see the need to find a solution that would liberate people from the traditional means of money transfers.

Kortina explained in the blog post that they felt lazy to follow the processes of traditional payments as Iqram had to find a check to repay him for the bills he took for him during the weekend and he equally had to make it to the bank to cash out the cheque. At this point, they saw the need for a more accessible system that works, especially for people sending small amounts of money or pals splitting bills.

Working Towards Making Venmo A Reality

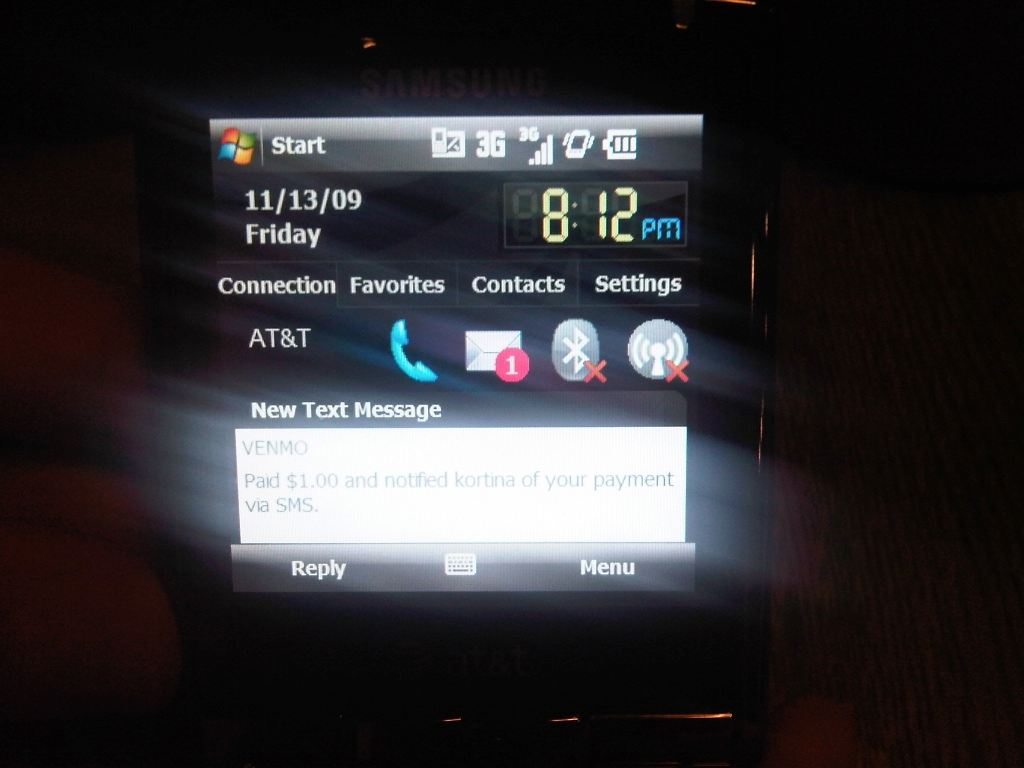

Having decided to solve the problem, they began experimenting with sending money through text messages. Thankfully, the first prototype did not only work over SMS but it was also very simple. To send $20 to Iqram, Andrew simply texted “iqram 20” to the phone number they had set up (which was a Google Voice account they had hacked) and Iqram received a message that read, “kortina paid you $20.”

In order to be able to keep track of what each payment was for, the duo decided to add a note to each text message. So, instead of “iqram 20”, it became “iqram 20 for thai lunch at Nooch.” The receiver on his own end will receive a message that reads “kortina paid you $20 for thai lunch at Nooch.”

Not long after, the duo’s SMS inbox was full of messages from their Venmo creation, making it look like a news feed of all the bars, shows, and restaurants they were going to “as well as emergent behavior like ‘$3 to pick me up a cup of coffee on your way in.” The stories were made up of quality information about how, where, and whom they were spending their time with. So they thought it necessary for people to be able to share this information and as a result, they included the #p option, which would make the payment appear in a friend’s feed on venmo.com.

Thus, Venmo was born. While their initial prototype was designed to send money via text message, the entrepreneurs later changed it to a smartphone app.

Venmo Funding

As soon as their prototype was up and running, Andrew and Iqram began showing it to potential investors in a bid to raise funds for the business. Meanwhile, at the time, they were both still working part-time at Bit.ly and Ticketleap, and had no plans of leaving their jobs until they had raised money to float their company. Subsequently, they raised $1.2 million of seed money in a financing bid led by RRE Ventures in May 2010 to support the company.

Date |

Investors |

Amount |

Round |

| _ |

|

N/A | –

Not yet verified

|

| Dec 2009 | N/A | $100k | Debt |

| May 2010 |

|

$1.2m | Seed |

| Aug 2011 |

|

N/A | Series A |

Venmo Investors

Investor Name |

Lead Investor |

Funding Round |

| betaworks | _ | Seed |

| Greycroft Partners | _ | Series A |

| Accel | _ | Series A |

| Vayner Media | No | Seed |

| Dave Morin | No | Seed |

| Sam Lessin | _ | Seed |

| General Catalyst Partners | _ | _ |

| Founder Collective | No | Seed |

| RRE Ventures | Yes | Series A, Seed |

| Lerer Hippeau | No | Series A, Seed |

| Dustin Moskovitz | No | Seed |

| Gary Vaynerchuk | _ |

This Is How The Digital Payment Platform Works

As stated earlier, Venmo is a mobile payment service. This means that it works best on mobile devices. It operates on a social platform that allows users to share and like payments and purchases through a social feed. Its resemblance to social media operations is the reason it is a favorite among millennials. But before you can join the Venmo train, there are things you must do. Being a mobile-only app, you will have to first install the application through either the play store or the app store.

Afterward, you will need to create a Venmo account using a valid email address, username, and password or use your Facebook account as an alternative. Once your account is set up, you need to provide a source for funding such as a bank account, credit card, or Venmo balance. The app will also require you to provide personal information including a mobile phone number for verification (KYC). Finally, you will have to verify your account using a 4 digit code sent to your mobile number.

All done, the account holder can send or receive money using Venmo. One can also transfer funds to one’s bank account or keep money in the Venmo account for future transactions. However, there are limits on the transactions that you can carry out via Venmo. New, unverified account holders cannot exceed $299.99 worth of transactions every week until their identity is verified.

To get verified, you will have to provide details such as your Social Security Number, your Zip Code, among others. Upon the verification of yot identity, you can send up to $4999.99 in each seven-day period and can also spend not more than $2000 on payments to vendors who partner with Venmo, making the total weekly limit $6999.99. The amount of money you can transfer to a bank account through Venmo is also limited. For a user who is yet to be verified, the limit is $999.99, but after verification, the limit spikes up to $19,999 every week. But the maximum amount you are allowed to send in one transaction is $2999.99.

How To Close A Venmo Account

Having an account on Venmo can save you a lot of stress, a reason for which you might love it, but truth be told, the experience can never be the same for everyone. While one person might have a wonderful experience using the app another person might have horrible stories to tell about it and as a result might decide to close his account. Whether you had a bad experience and decided to opt-out of the app or you just signed up and chose not to use it again, the fact is that closing a Venmo account is pretty simple. Just follow the steps below.

Log In

Connect your computer or phone to the internet and log into your Venmo account. Type in your password, but if you can’t remember it, request a new one so you can have access to your account. Meanwhile, if you make use of your account regularly, this will not be the case as you will have your password stored in the app. Once you are able to log into your account, you will be able to access the account closing feature.

Transfer Any Balance You Have Left in Your Account

If you have any money in your account at the time you want to close it, do well to transfer it either to your bank account or send it back to the sender if not, you won’t be able to access it again until you contact Venmo.

After you’ve done this, you’ll have to wait for the transaction to be completed before closing the account. Because this might take some days, you may have to come back later and finish up.

Delete Your Account

After your transfer is completed, go to your account settings. At the bottom of the page, you will see “Close My Venmo account”, then click on “Next”. Review the most recent statement on the account before you close it. When you are done, click on “Close Account”.

Check For A Venmo Message On Your Email

When you are done with the last process above, your account should be closed, but to be sure that it has closed properly, there is one last important step you must take. Go to the email address you linked to your Venmo account and check for a new email from Venmo. There should be a goodbye message and a history of your transactions.

How Does Venmo Make Money?

We already know that through Venmo, people can receive or send money, but how does Venmo make money from allowing people to use their services? Well, below are different ways the digital platform makes money to keep the app running.

Pay with Venmo

The “Pay with Venmo” feature is accessible to all who make use of the application. With it, users can make purchases from merchants who partner with Venmo. This means that if a user wants to purchase something from maybe Foot Locker, Urban Outfitters, or any other merchant that works in partnership with Venmo, he can choose the Pay with Venmo payment option. This option is very suitable, especially for users who are not comfortable inputting their credit card details to pay on the site.

Then, as the buyer/Venmo user pays with the app, a small fee that applies to the order amount is deducted. Merchants are charged 2.9% in addition to a $0.30 charge for every transaction.

Cashback Program

With the cashback program, Venmo users who own a debit card will enjoy the benefit of getting cashback rewards from merchants they patronize. Through this service, a user will have part of the price of the purchase he made sent back to his account. This will, most likely, prompt the user to keep purchasing at these merchants. Consequently, the merchant (or Venmo partner) will pay a certain percentage to Venmo for referring the customer.

Cash Interest

Venmo also makes some money through cash interest. This is how it works…Venmo lends the cash in the accounts of its users to different institutions such as banks, for example. And afterward, they are paid interest.

Instant Transfers

With Venmo instant transfers, users no longer have to deal with the issue of transferring money from an e-wallet and then wait for days before it reflects in their bank accounts. Just as the name implies, this feature allows one to transfer money instantly. News about this was all over the media in 2019 and prior to the inclusion of this service on the app, it took 1-3 days, depending on the case, for one to transfer money to one’s bank. But when you transfer money using instant transfer, it takes only 30 minutes to reflect in your bank.

This service is not free though. When you transfer money, you will be charged 1% of the amount you transfer. The minimum fee charged is $0.25 while the maximum is $10.

Interchange & Withdrawal Fees

In 2018, Venmo began giving debit cards to people who use their platform. So, anyone who creates an account on the digital platform will be issued a debit card, and just like any bank debit card, you can use it to make purchases, pay for things like dinner or drinks when you go out with friends. When you’re out with friends who use the app, you can even split the bill, which makes the app super convenient. The Venmo debit card is a branded Mastercard and it allows the platform make money by taking interchange fees from merchants. The fee is then divided between Venmo and Mastercard. One can also withdraw cash using this card at a small fee.

For example, when you withdraw money with the card in an ATM, a Domestic Withdrawal Fee of $2.50 will be charged while an Over-the-Counter Withdrawal Fee is $3.00.

Cash a Check

In January 2021, Venmo launched a new kind of service called Cash a Check. This service was made available in order for users to cash in their pay (a minimum of $5) and also the stimulus checks offered by the government. But there are requirements you must meet to use this service. These include a verified email address and either a Venmo Debit Card or Direct Deposit enabled.

To have the money deposited in your account, you must take a picture of the cheque and Venmo will then have it reviewed. If all goes well, the money will be deposited into your account. For this service, you’ll be charged just 1%.

How Much Are The Founders Worth?

Even though they are no longer the owners of the Venmo app, Andrew Kortina and Iqram Magdon-Ismail are believed to be living a comfortable life, and this is partly as a result of the digital platform which they created in 2009. As mentioned earlier, they sold the app for $26.2 million in 2012, becoming richer than they were before. They have also been involved in a number of things through which they earn a living since they sold Venmo, however, there is no available information about their net worth.

What Are They Up To These Days?

Since selling Venmo, its co-founders have moved on to other things individually. However, Andrew Kortina is still a part of the company as a Chief Financial Officer and Director, as revealed by a piece of information on crunchbase. In August 2015, he co-founded fin.com with Sam Lessin, a firm that helps companies to improve their business process definition, design software that is better and more productive for their frontline workers, understand factors that influence “the performance, productivity, and happiness of team members.”

Also, according to the information on his website, Andrew Kortina writes at kortina.nyc and he has an interest in exploring ideas which border on culture, technology, politics, consciousness, and philosophy.

On his own part, Iqram Magdon-Ismail remained affiliated with Venmo until January 2015. Presently, he spends his time working on a social voice platform called Ense, which he established on April 7, 2016, and headquartered in Greater New York Area, East Coast, Northeastern US. Through the social media platform, users are able to share stories, information, conversations, etc by making short audio clips.

Iqram has also invested in several companies such as Abacus Labs on Oct 29, 2014. In 2015, he invested $50 thousand in SoundScope and $500 thousand in hellotoken. The following year, he invested $785 thousand in Swipecast. He also invested $2.7 million in a company called Otherland in 2019 and on February 25, 2021, Iqram made his most recent investment in Stitch. He invested the sum of $4M in the seed round. Additionally, Iqram holds two board and advisor roles at Swipecast.