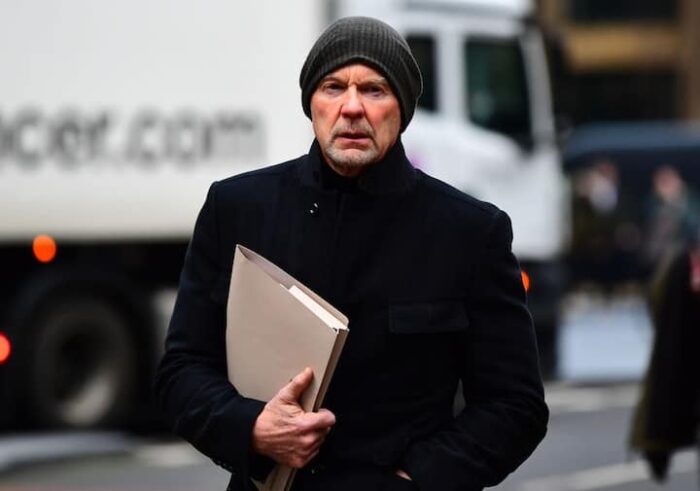

Roger Jenkins’ current net worth is pegged at $100 million. The British financier earned his fortune from his days as a management executive at Barclay’s Bank and other financial institutions. Roger also earned from the oil sector and through his entrepreneurial endeavors.

He started life as an athlete majoring in sprinting at the university level. After he graduated from college, Roger ventured into the financial sector, where he worked for a while before landing a job at Barclays that transformed his fortune. Though he has left Barclays, the British financier continues to have a stake in the firm as a consultant

How Much is Roger Jenkins’ Net Worth and Salary?

Roger Jenkins’s net worth is $100 million, according to estimates. Roger’s annual salary has never been calculated, however, it is common knowledge that he earned a large part of his fortune during his time as a staff of Barclays Bank when the Britsh man was declared to be the highest-earning banker in the whole of London. He reportedly received a total of $60 million as a salary at Barclays.

Several Sources Contribute to Roger Jerkins’s Net Worth

Though Roger Jenkins started small, the British citizen grew to become a well-known figure in the financial sector. He made his money as a former sportsman, financier, banker, and entrepreneur.

Roger Jenkins Started as an Athlete

Before venturing into the cutthroat world of finance, Jenkins was neck deep into athletics as a sprinter. While studying for a degree in economics at Heriot-Watt University located in Edinburgh, Scotland, Roger was a brilliant student and also athletically gifted. He ran track as a sprinter representing both Great Britain and Scotland at various completions.

He was at the European Championship of 1974, participated in the Commonwealth Games of 1978, and at the World Student Games of 1975 in Rome, Roger Jerkins emerged in second place, earning a silver medal in the process.

The full tale of the former sprinter’s athletic career is chronicled in Peter Hoffmann’s publication entitled, A Life In A Day In A Year.

His Pre-Barclays Career

Before scoring his life-changing job at Barclays Bank, Roger Jenkins made a brief stop at the London-based British multinational oil and gas firm known as BP plc. During his time at BP, Rogers worked in his capacity as a graduate trainee.

Even after he joined Barclays in the later part of the 1970s, the British financier left around 1978 to spend seven successful years as an employee of the known leading investment bank called Kleinwort Benson. At Kleinwort, Rogers was the Co-Head of Financial Markets and also functioned as the company director before he finally returned to Barclays Bank in 1994.

Jenkins Started Work as a Graduate Trainee at Barclays Bank

Fortune smiled on Roger Jenkins in 1978 when Barclays employed his services as a graduate trainee. He had earlier completed his university degree in 1977 before going into the labor market.

Though he started from the bottom, Roger climbed the corporate ladder very fast and was sitting at the helm of affairs before he eventually left the financial institution.

For a couple of years between 1982 and 1984, Barclays entrusted Roger with its investment banking division which oversaw the private placements unit in New York known as Barclays de Zoete Wedd (BZW).

It was a short while later that he left for Kleinwort Benson, and when he made his comeback in 1994, Rogers started serving in other positions. He was charged with the responsibility of setting up a group of advising firms on both tax and regulatory management, and their function was developing and analyzing different countries’ tax regimes.

He achieved a great feat in his division, Structured Capital Markets. Between 2000 and 2011, the unit generated a whopping 9.5 billion pounds.

WSJ Investigation revealed Other Sources of Roger Jenkins Income

Roger Jenkins’ activities and recorded successes in the financial sector must have triggered suspicions from the authority as he came under heavy investigation. Following this, some juicy investigation reports surfaced from Wall Street Journal alleging that the British financier and his team launched a firm called Augustus Funding LLC.

A detailed report from Wall Street Journal revealed that Augustus Funding LLC had no known product, never hired any employees, and had no customers or clientele base. However, it still managed to record a pretax yield of $317 million in 2004. The funds were discovered to be locked up in assets like Danish mortgage securities and US treasuries.

Out of its total takings, Augustus Funding LLC paid taxes in excess of $94 million. According to the conclusions drawn from the Wall Street Journal reports, Augustus Funding is part of the nine structures involving US bank Wachovia that Barclays set up. Despite the fact that it was incorporated in Delaware, the company had a London address with British directors.

Roger Jenkins was Instrumental in Selling iShares at Barclays

During his day as top management staff of Barclays Bank, Roger Jenkins was opportune to play a vital role when the financial institution attempted to sell the iShares asset management business; the target was to sell to the private equity firm, CVC, but sadly, Roger and his team failed to close the deal. Later in June 2009, the United States-based company BlackRock successfully bought Barclays Global Investors, and it went for the whooping sum of $13.5 billion.

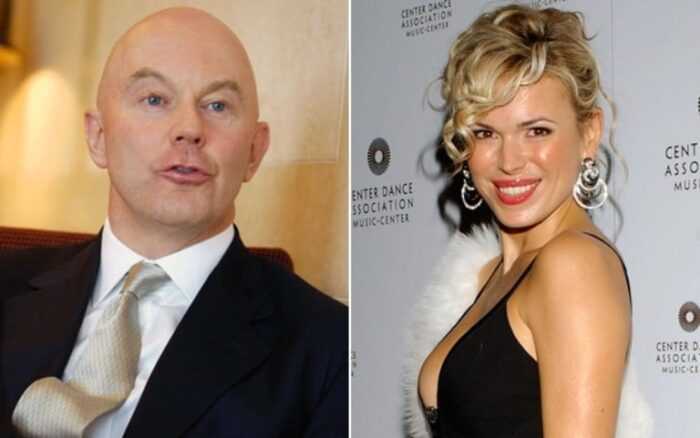

In addition to his contribution to marketing Barclay’s iShares, Roger was also involved in another big transaction closed by the financial institution. With the help of his second wife, he got inroads into the ruling families of both Qatar and Abu Dhabi, and in 2008, the British financier played a key role in locking in the 7.3 billion pound investment both families made in Barclays.

He Also Has A Stake in the Cannabis Business

After he left Barclay’s Bank in 2009, Roger Jenkins was still functioning as a consultant for the financial institution. However, he went on to establish himself as an entrepreneur with several business ventures under his belt.

In February 2010, he launched Elkstone Capital – a Dublin-based advisory firm. The Middle East Company focused on opportunities generated by the Irish financial crisis.

Joining BTG Pactual – a known Brazilian investment bank, in October 2011, Jenkins worked as its managing partner

Roger went on to invest large funds in acquiring a North Carolina-based cannabis cultivation facility in 2016

He also served at Murphy Oil in different capacities as the President, CEO, and Director bagging a total compensation of $18,804,400. This made him the highest-paid executive at the company.

Roger Jenkins Paid Out a Fortune in Divorce Settlement

Following the crash of Roger’s marriage with his wife number two, Diana Jenkins, reports revealed that he paid out half of his fortune to his ex-wife.

According to what Roger Jenkins said in a 2011 interview session with The Telegraph, it is all thanks to Diana that he attained the height he now enjoys in the financial world. He credits his ex-wife for her role in persuading the Qatar and Abu Dabi royal family to make huge investments in Barclays at the peak of the global financial crisis.

In light of that, Roger said he was happy to share his wealth with Diana and has no regrets.